VMware customers fear Broadcom acquisition will hike costs • The Register

[ad_1]

Analyst firms S&P Global Industry Intelligence and Gartner have both equally supplied unfavorable evaluations of Broadcom’s takeover of VMware.

S&P surveyed VMware buyers and found 44 per cent sense neutral about the offer, and 40 p.c expressed destructive sentiments.

But when the analyst crunched the quantities for recent prospects of both equally VMware and Broadcom, 56 p.c expressed negative sentiments. A lot more than a quarter rated their reaction to the deal as “exceptionally detrimental”.

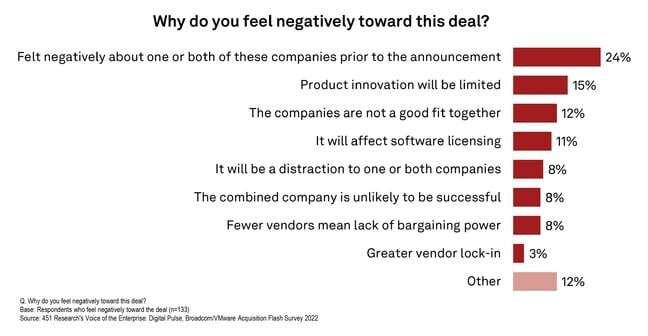

A person purpose S&P cited for that reaction was “possible affect on software licensing terms and conditions. Here is the analyst’s record of other worries raised by end users:

Analyst team Gartner’s ideas on the offer emphasis on likely value rises, and how finest to steer clear of them.

In a doc titled “Speedy Respond to: How Should VMware Customers Put together for the Broadcom Acquisition?” Gartner’s analysts produce: “Soon after Broadcom’s acquisitions of CA Systems and Symantec, numerous shoppers complained to Gartner about extraordinary out-the-door expense will increase all through renewals, with constrained overall flexibility for negotiations.”

The analyst group also sees “an inflow of midsize and lesser buyers hunting to migrate absent due to amazing price tag raises and difficulties with support.”

Gartner therefore suggests VMware shoppers really should lock in extended-phrase pricing with VMware prior to the Broadcom deal concludes.

“Alter negotiating practices and mandate that VMware commit to precise provisions in creating prior to generating significant or strategic economical investments,” the document advises, noting that it will be quite a few months before the acquisition is finish.

“Negotiate exit clauses in new multiyear contracts,” the document adds. “Negotiate cost caps on subscription VMware license fees. Price tag caps should really be within just 1 % to two % of a typical metric this sort of as the client rate index.”

Other assistance calls for shoppers to safe commitments for shipping of technological enhancements for VMware solutions, especially code other than vSphere, NSX and vSAN.

And just in circumstance Broadcom makes everyday living intolerably miserable, Gartner recommends VMware end users “Determine exit ramps for deployed items, such as alternative solutions and migration actions.”

Gartner also sees some upside in the acquisition, particularly the likelihood of:

- Enhanced co-engineering with Broadcom’s current portfolio, leading to item integration enhancements. Some potential illustrations include VMware Job Monterey with Broadcom’s semiconductor enterprise, Broadcom’s ValueOps with Tanzu and a sturdy one-seller SASE featuring

- Expected solid ongoing financial investment in the VSAN, NSX and vSphere products and solutions, as Broadcom seeks a emphasis on hybrid clouds

- Improved breadth of technological assets of the put together entities to compete extra correctly with AWS, Microsoft, Google and IBM/Pink Hat.

S&P’s exploration includes just one user’s opinion that Broadcom may possibly be the suitable operator for VMware, simply because if other company computing giants obtained the virtualization leader it would be challenging to sustain the “Switzerland of cloud” standing VMware covets.

One more Gartner prediction is that Broadcom may possibly rationalize some goods, as the artist previously recognised as Symantec and VMware’s Carbon Black unit equally supply endpoint protection items, even though CA sells and visibility and automation applications.

Gartner’s information nods to Broadcom’s public statements that it focuses its focus on pretty substantial customers and trims R&D shell out aimed at scaled-down buyers, and designs a speedy shift away from perpetual licenses for VMware goods. Broadcom has also stated that it expects VMware to generate almost $4 billion extra once-a-year revenue by 2025 – significantly quicker progress than the virtualization giant has attained in the latest yrs.

Broadcom execs have mentioned the corporation options to go on financial commitment in main VMware solutions, and that it sees VMware’s lover group as providing possibilities and opportunities it can not at the moment tackle.

S&P’s analysis also suggests Broadcom’s remarks about the VMware channel signal the chip style business will not utilize the very same methods it employed after buying CA and Symantec.

But Broadcom’s former cost hikes and indifference to smaller sized buyers are at the moment the most seen proof of its tactic acquisitions, leaving VMware customers The Sign-up encountered anxious about the effect of the acquisition. ®

[ad_2]

Supply hyperlink