Burned by Tech Stocks? Consider These 3 ETFs Instead

[ad_1]

Investors can’t decide how they’re feeling about tech stocks right now. The Nasdaq 100 Technology Index has made sizable moves up and down recently — and now sits on a double-digit loss for this year.

Unfortunately, hopping off the tech-stock roller coaster may be harder than you think. Seven of the largest 10 companies in the S&P 500 index are in tech (eight if you consider Tesla a tech company).

Image source: Getty Images.

Tech’s influence on the broader market

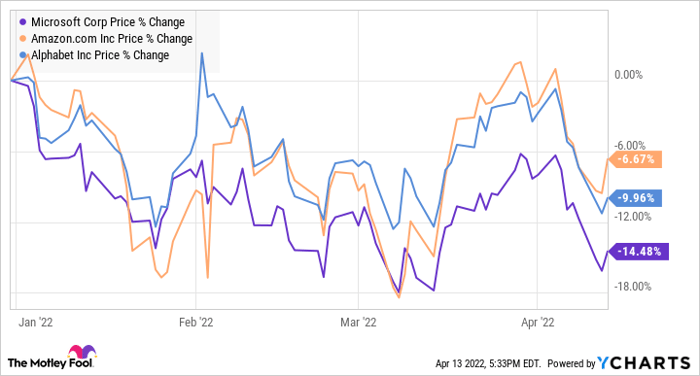

The list of S&P 500 tech stocks includes Microsoft, Alphabet, and Amazon. As you can see in the chart below, all three have negative year-to-date performance. Worse, these stocks and their large-cap tech peers are heavily represented in index funds and ESG funds, not to mention tech funds.

MSFT data by YCharts.

There are times when increasing your exposure to a broad market index fund can be a defensive tactic. But that strategy won’t help right now if you’re sick of getting burned by tech.

What you can do is increase your exposure to ETFs that invest in stable sectors like consumer goods, utilities, and healthcare. Because these sectors sell products and services that people need (vs. want), they’re less sensitive to temporary economic conditions.

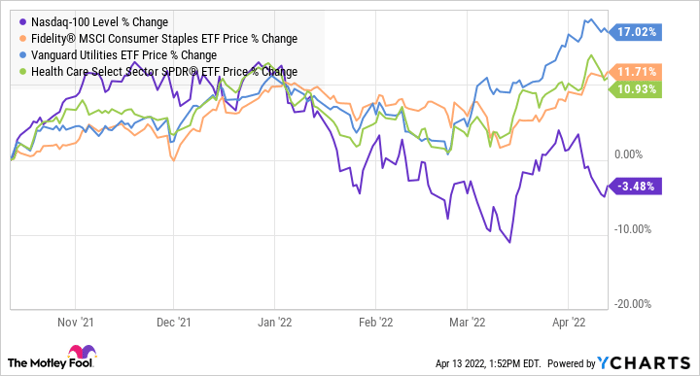

For an idea of how these sectors have behaved differently from tech recently, see the chart below. It shows the performance of three stable sector ETFs vs. the Nasdaq 100 index over the last six months.

^NDX data by YCharts.

Those sector ETFs may look very comforting, but there’s a huge caveat here. Six months is a short window of time. Stretch this chart out to cover the last five or 10 years, and you’ll see that tech has wildly outperformed these other sectors.

This is why changing up your portfolio in response to temporary market conditions can easily backfire. When tech eventually stabilizes, you may regret overinvesting in lower-growth sectors.

On the other hand, diversifying more outside of tech — or any one sector — is smart. That’s especially true in two scenarios. One, you may not have realized your heavy exposure to tech if that exposure is mostly through funds. And two, your risk tolerance may be lower than it was when you built your portfolio, and now you’re ready to get more conservative.

If one of those situations applies, read on for some key stats on the three ETFs shown in the chart above.

1. Consumer Staples ETF

Fidelity MSCI Consumer Staples Index ETF (NYSEMKT: FTEC) holds 99 large-, mid-, and small-cap consumer staples stocks. The fund’s top 10 holdings include Proctor & Gamble, Coca-Cola, Costco, and Pepsi.

FTEC’s 30-day SEC yield, a standardized measure of dividend yield, is 2.11%. The fund’s total average return over the last five years is 9.74%.

2. Utilities ETF

Vanguard Utilities ETF (NYSEMKT: VPU) holds 64 utilities stocks such as Duke Energy and wind and solar energy-producer NextEra Energy. The top 10 holdings comprise 54% of VPU’s total net assets — a fairly heavy concentration.

The fund pays out a 2.7% dividend yield, per the 30-day SEC yield formula. The five-year average annual returns are 10.87%.

3. Healthcare ETF

The Health Care Select Sector SPDR Fund (NYSEMKT: XLV) invests in healthcare companies that are also in the S&P 500. This approach gives you the sector exposure you want, plus a focus on larger, established organizations.

There are 64 stocks in the XLV portfolio, including UnitedHealth Group, Johnson & Johnson, and Pfizer. Like VPU, this fund has a top-10 concentration of more than 50%.

XLV has a 30-day SEC yield of 1.3% and has returned an annual average of 15% over the last five years.

Diversify for stability

The recent tech sell-off is a reminder not to bet too big on any one sector — even technology. To diversify outside of tech and build more stability into your portfolio, consider ETFs in less cyclical sectors. Consumer staples, utilities, and healthcare are three examples.

If tech stocks are roller coasters, stocks in these stable sectors are more like tilt-a-whirls. You may still need a seatbelt, but the highs and lows should be less extreme.

10 stocks we like better than Fidelity MSCI Information Technology Index ETF

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Fidelity MSCI Information Technology Index ETF wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of April 7, 2022

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Catherine Brock owns Coca-Cola, Johnson & Johnson, Microsoft, and Procter & Gamble. The Motley Fool owns and recommends Alphabet (A shares), Amazon, Costco Wholesale, Microsoft, NextEra Energy, Nasdaq, and Tesla. The Motley Fool recommends Alphabet (C shares), Duke Energy, Johnson & Johnson, and UnitedHealth Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Source link