Bullish Amkor Technology, Inc. (NASDAQ:AMKR) investors are yet to receive a pay off on their US$137m bet

[ad_1]

Insiders who acquired US$137m worth of Amkor Technology, Inc.’s (NASDAQ:AMKR) stock at an typical buy rate of US$24.68 around the very last yr may well be upset by the latest 12% lower in the inventory. Insiders devote with the hopes of viewing their money grow in value in excess of time. Nevertheless, as a outcome of latest losses, their preliminary expenditure is now only truly worth US$93m, which is not what they predicted.

Even though insider transactions are not the most significant detail when it arrives to extended-term investing, logic dictates you need to shell out some awareness to no matter if insiders are purchasing or advertising shares.

Check out our most recent analysis for Amkor Technological innovation

The Last 12 Months Of Insider Transactions At Amkor Technologies

The Government Chairman of the Board James Kim made the most significant insider acquire in the final 12 months. That one transaction was for US$92m really worth of shares at a value of US$24.68 each. So it really is apparent an insider wanted to invest in, even at a better cost than the present share price (remaining US$16.65). When their check out may possibly have altered due to the fact the acquire was created, this does at least recommend they have had self esteem in the company’s upcoming. To us, it can be really essential to look at the value insiders shell out for shares. Generally talking, it catches our eye when insiders have obtained shares at previously mentioned present-day costs, as it suggests they believed the shares had been value obtaining, even at a higher selling price.

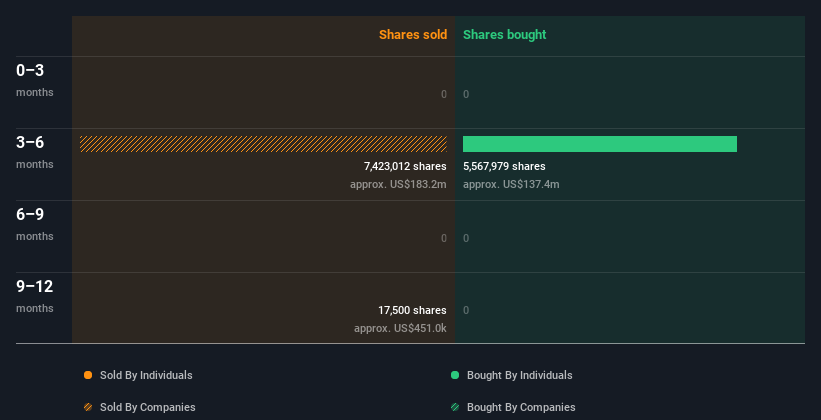

Fortunately, we observe that in the past year insiders paid out US$137m for 5.57m shares. But they sold 17.50k shares for US$436k. In complete, Amkor Technology insiders bought far more than they bought around the last 12 months. You can see a visual depiction of insider transactions (by companies and people today) around the past 12 months, underneath. If you simply click on the chart, you can see all the personal transactions, such as the share cost, person, and the day!

Amkor Technologies is not the only stock insiders are getting. So choose a peek at this free list of rising organizations with insider buying.

Insider Ownership of Amkor Technologies

I like to glance at how lots of shares insiders own in a corporation, to assistance notify my perspective of how aligned they are with insiders. I reckon it truly is a good signal if insiders very own a important amount of shares in the enterprise. It truly is fantastic to see that Amkor Technological innovation insiders personal 52% of the company, value about US$2.1b. This variety of substantial ownership by insiders does typically improve the prospect that the business is operate in the interest of all shareholders.

What Might The Insider Transactions At Amkor Technology Explain to Us?

It does not actually necessarily mean a lot that no insider has traded Amkor Technological innovation shares in the final quarter. Even so, our analysis of transactions more than the last year is heartening. It would be fantastic to see much more insider shopping for, but general it seems like Amkor Technological innovation insiders are moderately very well aligned (possessing significant chunk of the firm’s shares) and optimistic for the future. So these insider transactions can assistance us build a thesis about the stock, but it is really also worthwhile figuring out the hazards going through this organization. At Simply just Wall St, we uncovered 1 warning signal for Amkor Know-how that are entitled to your awareness before getting any shares.

But be aware: Amkor Know-how may perhaps not be the very best stock to acquire. So take a peek at this totally free record of interesting firms with high ROE and lower financial debt.

For the reasons of this post, insiders are those people today who report their transactions to the applicable regulatory body. We at this time account for open up market place transactions and private inclinations, but not derivative transactions.

Have opinions on this report? Involved about the content? Get in contact with us right. Alternatively, email editorial-staff (at) simplywallst.com.

This short article by Basically Wall St is general in nature. We supply commentary based on historical info and analyst forecasts only applying an impartial methodology and our articles or blog posts are not supposed to be financial tips. It does not constitute a advice to invest in or sell any stock, and does not acquire account of your aims, or your money situation. We aim to provide you very long-expression centered examination pushed by elementary info. Observe that our evaluation may well not factor in the most up-to-date price-delicate corporation bulletins or qualitative materials. Simply just Wall St has no place in any stocks stated.

[ad_2]

Source website link