BlackSky Technology: The View From Above (NYSE:BKSY)

[ad_1]

BlackJack3D/E+ by means of Getty Visuals

“Only when the tide goes out do you find who’s been swimming bare.” – Warren Buffett

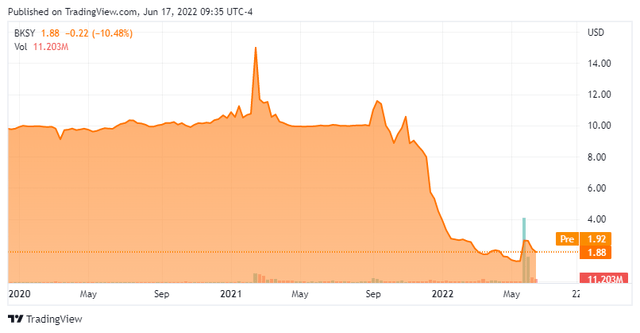

Now, we take our 1st in-depth search at small-cap worry BlackSky Technological know-how Inc. (NYSE:BKSY). BlackSky arrived public late previous summer season via a merger with Osprey Engineering Acquisition. Like so lots of of these SPAC debuts in 2021, the shares obtain on their own deep in ‘Busted IPO’ territory. The business is providing spectacular earnings growth in its rapid-growing area of interest of the industry, however. An examination follows down below.

Trying to get Alpha

Enterprise Overview:

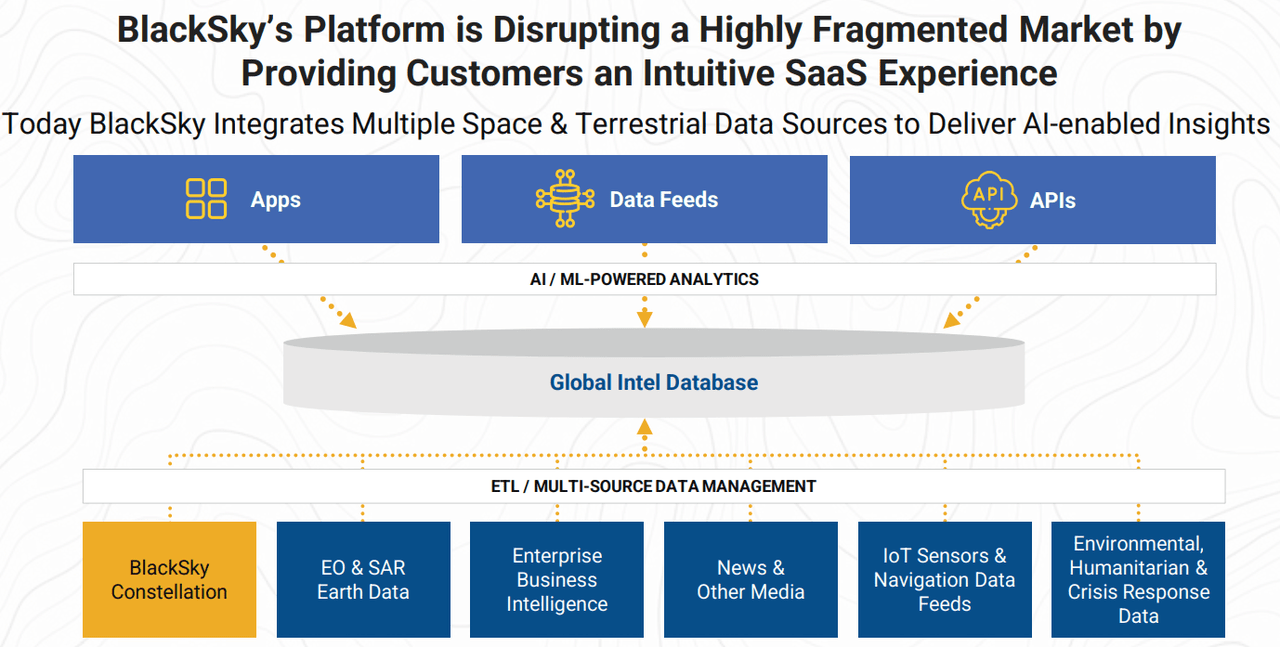

BlackSky Know-how Inc. is based mostly just exterior of Washington D.C. The inventory trades for just less than two bucks a share and sports activities an approximate market capitalization of $240 million. BlackSky supplies geospatial intelligence, imagery and related facts analytic goods and products and services, and mission methods. These include things like the development, integration, and functions of satellite and ground systems to business and governing administration customer applications. The corporation delivers these insights and knowledge by means of its Spectra AI SaaS platform which is run by their proprietary space and terrestrial sensor community.

BlackSky’s on-demand from customers constellation of satellites (a overall of 14 proper now following launching two satellites on April 2nd) can impression a locale several situations in the course of the day. Palantir Systems (PLTR) has an equity expense in BlackSky. BlackSky also has a multi-year program subscription deal with Palantir to access the Palantir Foundry organization platform, and the company gives a resolution that combines Palantir Foundry with its Spectra AI to develop the shipping of deep analytics and superior-resolution imagery to its consumers.

Company Presentation

1st Quarter Effects:

On May 11th, the organization posted very first quarter effects. BlackSky experienced a internet loss on a GAAP foundation of 17 cents a share. Revenues rose 90% from the identical period a year in the past to just under $14 million, which properly beat anticipations. Of this, Imagery and software package analytical companies earnings came in at $9.8 million. This was largely driven by greater need from new and present federal government contracts. This segment now represents close to 70% of complete revenues and was up 63% from the very same period of time a calendar year ago. Gross margin did tumble to 21.2% from 24.5% in 1Q2021. Administration attributed this generally to ‘bigger engineering and units integration fees mostly attributable to non-recurring style charges and content procurement costs’.

Management maintained full 12 months profits advice of between $58 million to $62 million. That would signify 76% revenue progress from FY2021 at the midpoint of that variety. Cap-Ex is predicted to be concerning $52 million to $56 million, down from past 12 months as management believes it has adequate capacity to meet up with customer demand. On June 15th, management reaffirmed steerage and also declared a new CFO.

In late Could, the National Reconnaissance Office environment declared its most significant-at any time business imagery agreement energy worthy of billions of pounds more than time. BlackSky was a single of three firms preferred together with Earth Labs (PL) and Maxar Systems (MAXR). The over-all agreement became successful as of late Might of this year with a 5-year foundation and various 1-year selections with more growth by way of 2032.

Analyst Commentary & Stability Sheet:

On May well 12, Benchmark lowered its rate focus on on BKSY to $6 from $8 previously when sustaining its Acquire ranking on the inventory. That is the only analyst organization commentary I can uncover on BlackSky so much in 2022. Just beneath 10% of the remarkable float on this fairness is at the moment sold small. Just after posting a net reduction of $20 million through the quarter, the company had just over $138 million in cash and marketable securities as of March 31st of this yr, against just over $70 million of extensive-time period debt. An insider purchased $32,000 really worth of inventory in late February. That is the only insider activity in the stock so significantly in 2022.

Verdict:

The 1 analyst organization that has delivered projections about BlackSky has the firm dropping 81 cents a share this yr as revenues just about double to $67.5 million in FY2022. Web reduction is projected to fall to 47 cents a share in FY2023 with revenues growing virtually 90% to $127 million.

BlackSky is in an interesting and growing market of the market. The present-day conflict in Ukraine has underscored the crucial value of real-time Earth intelligence for armed service, commercial, humanitarian and other apps. The market has crushed virtually all profitless tiny-cap expansion names in modern months, regardless of their expansion prospective clients. This continues to be a headwind.

This inventory appears to be reasonably priced based on rate to future profits, primarily when the web money on the harmony sheet is taken into thing to consider. I not too long ago profiled Earth Labs and took a ‘check out merchandise‘ keeping in that related worry. I approach to do the very same with BlackSky Technologies. We will program to revisit BlackSky again in 2023 as sales keep on to get traction, and ideally as internet losses fall noticeably.

“It is a way to get people’s prosperity from them without the need of acquiring to openly elevate taxes. Inflation is the most universal tax of all.” – Thomas Sowell

[ad_2]

Resource connection