3 reasons why investors should warm up to technology stocks after their months long sell-off, according to Fundstrat

[ad_1]

-

Buyers really should get technology stocks following their months very long market-off entered bear industry territory, according to Fundstrat.

-

“Traders deem Engineering ‘done’ but we consider Technological know-how need will accelerate [over the] future number of decades.”

-

These are the a few factors why Fundstrat’s Tom Lee thinks investors must purchase technology stocks.

Technology stocks went from most cherished in several years of the COVID-19 pandemic to now the most heavily offered, centered on the underlying sector functionality of the inventory market place.

The Nasdaq 100 fell into a bear sector in 2022, dropping about 30% from its history higher, which is a larger drop than the index knowledgeable in March 2020. A blend of lofty valuations, a pull forward in need, and increasing fascination fees aided fuel the months-extensive decrease in the sector, amid other elements.

But buyers should acquire edge of the drop and start buying the tech sector, according to a Monday note from Fundstrat’s Tom Lee. “Investors deem Engineering ‘done’ but we believe Technologies desire will speed up [over the] subsequent number of many years,” Lee stated.

Lee presented 3 major reasons why it still helps make feeling to individual the tech sector for the very long-time period, even as more common economic climate sectors like power go on to soar.

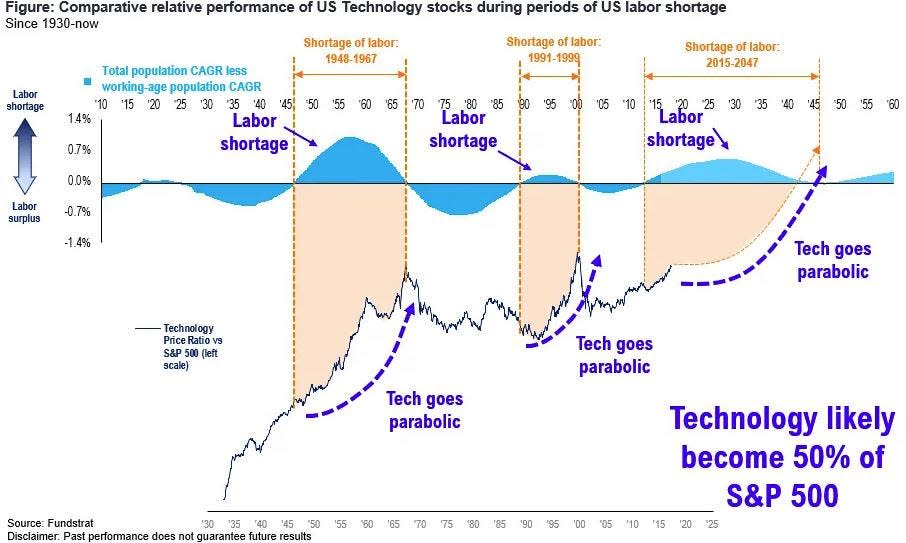

1. “Technological innovation need will speed up as organizations search for to offset labor lack.”

“World-wide labor provide is shrinking vs . desire. Our 2017 assessment displays the world is moving into a period of labor lack. Progress rate of staff age 16-64 is trailing total inhabitants advancement, starting up in 2018. This reverses employee surplus in spot considering the fact that 1973,” Lee stated.

The world labor lack is a long-phrase option for technological innovation and automation to move up and fill the gap, in accordance to Lee.

“2022 is accelerating the use case and ROI for automation. If bare minimum wages are soaring, [and] businesses are boosting starting up salaries, this raises the ROI and justification for labor substitution by way of automation. This is an apparent need accelerator for Technology — aka $QQQ Nasdaq 100,” Lee reported.

2. “Know-how valuations are reduced than the 2003 trough.”

The Nasdaq’s price tag-to-earnings ratio these days is reduce now than it was at the depths of its dot-com unwind, when the Nasdaq 100 declined by almost 80% from its 2000 peak, in accordance to Lee. “Nasdaq 100 is more affordable nowadays than at the absolute 70-year lower of 2003. Yup, markets crashed even worse than dot-com,” Lee claimed.

“If anything, this really should affirm why the chance/reward in FAANG is desirable. Even anecdotally, the lousy information appears to be priced in,” Lee claimed.

3. “Technology has led off just about every key base.”

“What outperformed soon after dot-com crash? Technologies stocks… yup. The need tale for Technology is likely set to accelerate in next couple many years, and just about every significant market place bottom sees Nasdaq base 4-6 months ahead,” Lee explained.

Following the both equally dot-com bubble burst and the Wonderful Money Crisis, the Nasdaq outperformed other indices in excess of the future 5 decades, in accordance to Lee. “This chart claims it all… we feel FAANG guide publish growth scare,” Lee concluded.

Go through the unique posting on Organization Insider

[ad_2]

Supply backlink